This week, the magnesium market showed a weak supply-demand balance, with prices initially declining before rebounding, though fluctuations remained limited. Market sentiment was cautious, and prices are expected to continue fluctuating within a narrow range in the short term.

This week, the magnesium market showed a weak supply-demand balance, with prices initially declining before rebounding, though fluctuations remained limited. Market sentiment was cautious, and prices are expected to continue fluctuating within a narrow range in the short term.

Dolomite:

This week, dolomite prices remained stable overall. Inventory levels in the main production area, Wutai, were sufficient, while producers in other regions effectively filled local demand gaps through flexible restocking strategies. Supply remained steady, and with freight costs dropping to multi-year lows, dolomite delivery costs slightly decreased, further easing procurement pressure. Given the balanced supply-demand situation without significant conflicts, dolomite prices are expected to remain stable in the near term.

Magnesium Ingot:

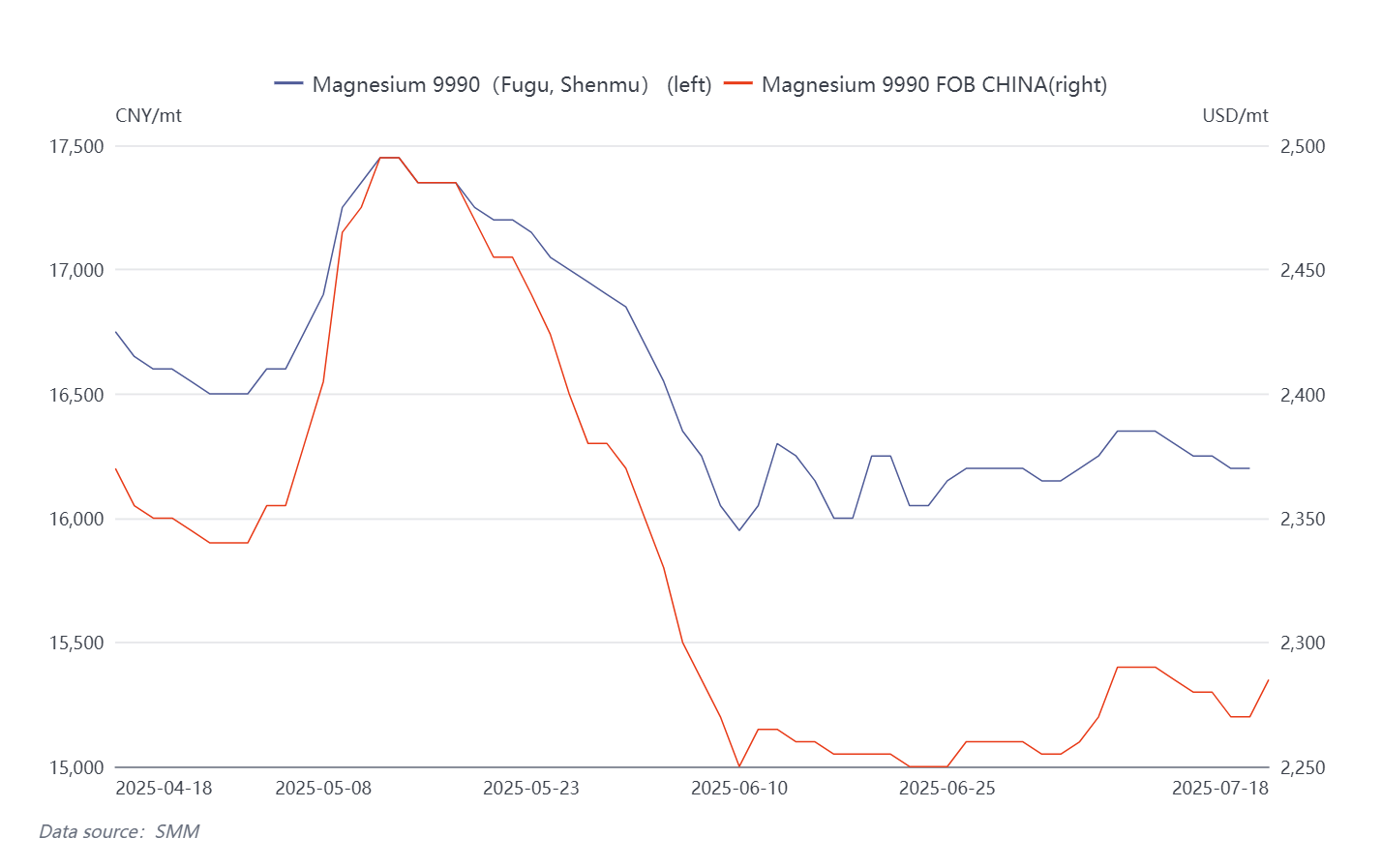

As of this report, the mainstream transaction price for 90% magnesium ingot in key production areas was RMB 16,300/ton, with FOB offers at $2,285/ton. The magnesium ingot market saw a dip-and-rally trend this week, maintaining a consolidating pattern. Prices started the week stable at RMB 16,200-16,300/ton, dipped by RMB 50/ton midweek due to demand fluctuations, and rebounded slightly toward the weekend. On the supply side, production resumed gradually in key regions, increasing market supply, but producer inventories remained low, reinforcing their firm pricing stance. Demand remained relatively stable, with domestic buyers maintaining just-in-time purchases and midweek trading activity picking up. Exporters also actively procured for deliveries, providing some support. Internationally, mainstream transaction prices held at $2,250-2,280/ton, with European traders mostly on the sidelines while Japanese and Korean buyers increased purchases, leading to a noticeable rise in signed contracts. Overall, the market remains in a low-level supply-demand balance. Although demand has softened seasonally, price support at the bottom remains solid.

Magnesium Alloy:

As of this report, magnesium alloy prices were quoted at RMB 17,900-18,000/ton, with FOB offers at $2,515/ton. This week, magnesium alloy prices followed the downward trend of raw magnesium ingots, reflecting a weak supply-demand balance. On the supply side, some producers reduced output, adopting a production-to-order strategy and lowering operating rates. Demand remained sluggish due to a lull in overseas orders and the traditional off-season for domestic die-casting. Market transactions were mainly driven by essential purchases. With clear standoffs between upstream and downstream players, magnesium alloy prices are expected to fluctuate within a narrow range in the short term.

Magnesium Powder:

As of this report, magnesium powder was quoted at RMB 17,550/ton, with FOB offers at $2,430/ton. This week, magnesium powder prices declined following the drop in raw material costs. Supply remained stable, with producers maintaining steady output and low inventory levels. Downstream buyers remained cautious, mostly making purchases based on immediate needs, leading to subdued trading activity. After last week’s concentrated buying, transaction momentum weakened noticeably this week, with magnesium powder producers returning to an order-based procurement model. Both upstream and downstream participants adopted a wait-and-see approach, and the market is expected to maintain a weak balance in the near term.